Gold has always been the safe haven and the natural hedge for all calamities. We have been conditioned from childhood that gold is a safe investment. So I started studying gold and understanding how and why gold investment is crucial and how to go about investing in it. Thanks to my IIMK alumini network and very knowledgeable sessions conducted and through my own research, I found a few things that might interest you. Lets dig in..

Long-Term: Central Banks Are the Real Movers

In the long term, central banks play the biggest role in shaping gold prices. They’re not chasing daily market trends. Instead, they’re making strategic, generational decisions and this is the general direction in which Gold will move in a long term.

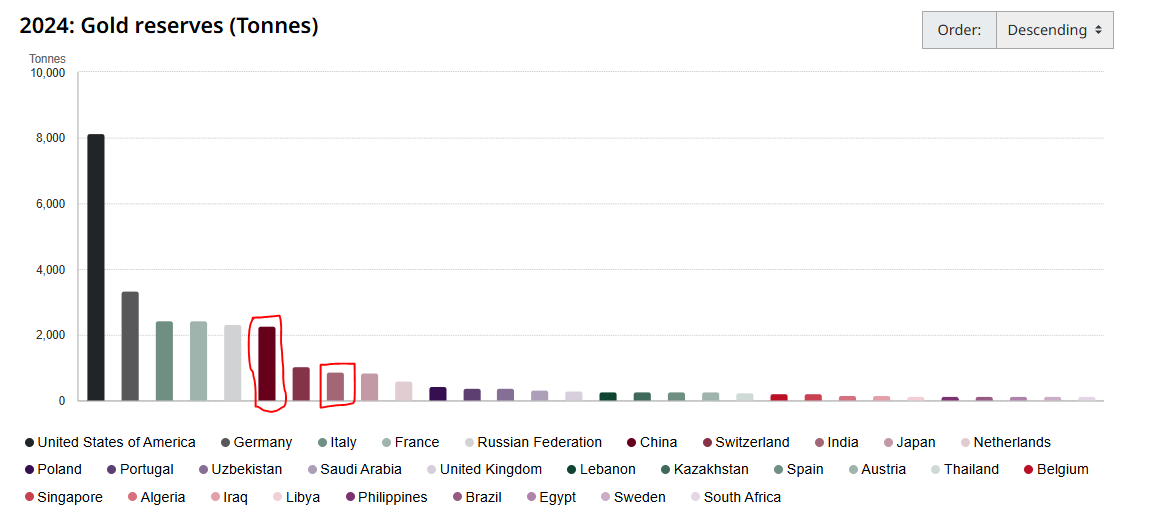

Looking at the current gold reserves(source: WGC data), we see that U.S. holds the largest gold reserves—over 8,400 tonnes. However, China and India, two of the largest economies today, are still a lot behind on that front. And that gap is important.

Both China and India will continue accumulating gold reserves over the coming decades. That means, structurally, there’s long-term buying pressure baked into the system.

Short-Term: Key movers come from the Fed rates & Inflation data

Now let’s zoom in. In the short term, two things very closely:

- U.S. inflation data

- The Federal Reserve’s interest rate decisions

These two factors regularly shake gold markets. But not always in the direction people assume.

When the Fed cuts interest rates

Most folks expect investors to jump from treasuries and gold into stocks. That’s true to some extent.

But here’s what what actually happens: a lot of money leaves treasury bonds because yields drop, and some of that capital also moves into gold.

So instead of falling, gold prices often rise after a rate cut. It’s a counterintuitive reaction.

When the Fed raises interest rates

The reverse tends to happen. Bonds become more attractive.

Money flows out of stocks and gold, and gold prices dip.

Inflation Isn’t Just Inflation—It’s About Expectations

People love to say that gold is an inflation hedge. That’s half true. It’s not the inflation itself, but how markets expect the Fed to respond that determines gold’s movement.

- If inflation is rising, markets start pricing in rate hikes—and gold tends to fall.

- If inflation is falling, people anticipate rate cuts—and gold often climbs.

It’s a subtle but powerful distinction. Gold isn’t just reacting to CPI numbers—it’s front-running the Fed.

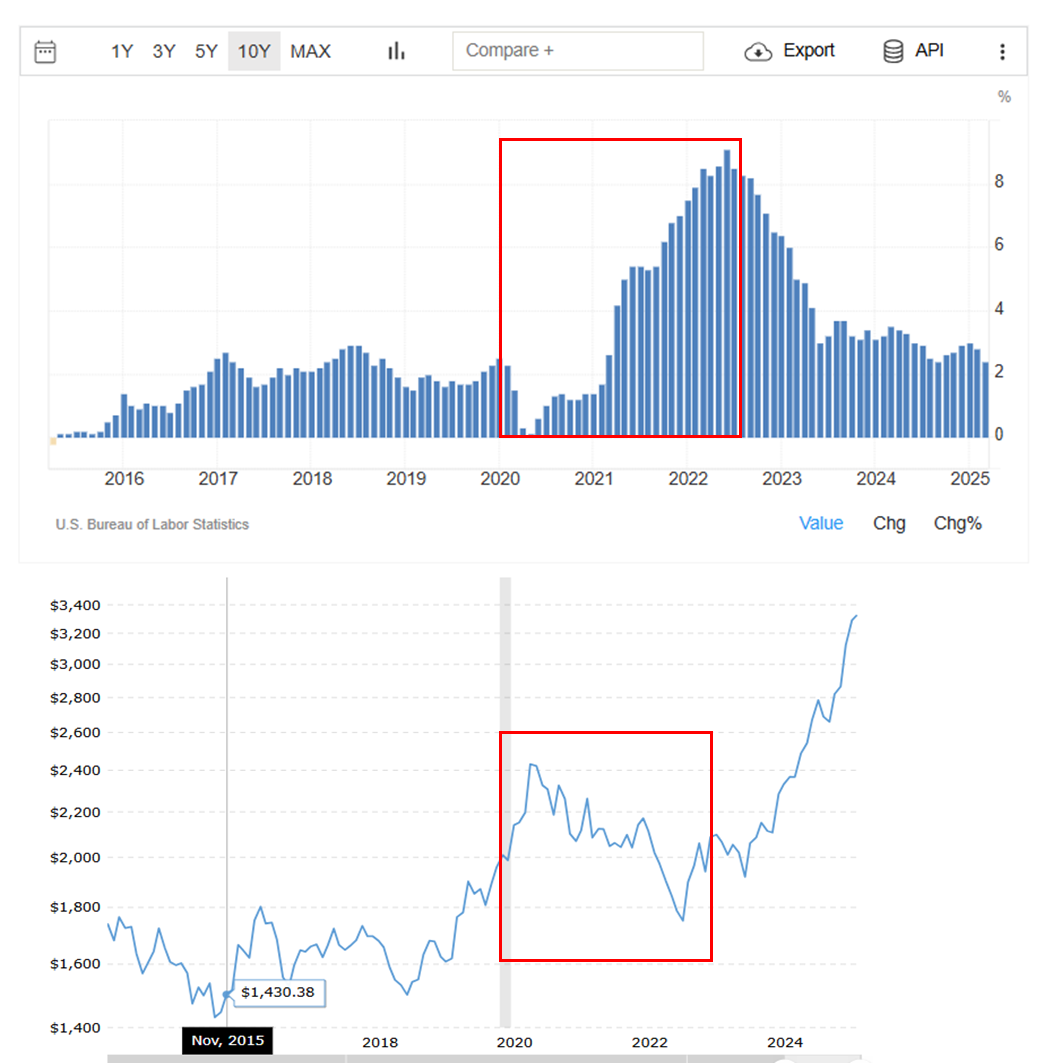

In the below graph, observe the data between 2020 till 2022. inflation increased continously and gold prices fell continously during the same period.

Ofcourse, because of the global uncertainity the gold had run up a lot more than expected, but you get the general trend :)

My Takeaway

So, when to invest into gold and when to pause?

- If US inflation data is on rise, that is a good time to slowdown or pause the gold investments as gold might not increase in value as long as that inflation is increasing.

- If Fed decides to raise interest rates, again, that would be the time to pause or slow down on the gold investments

- As the long term investor, one should always stay invested in gold.

Understanding these dynamics has helped me cut through the noise and see gold for what it really is: a strategic asset that reflects not just fear or inflation—but where money wants to move next.

Disclaimer: I am not a official SEBI registered advisor. These are just my opinions based on my research